However, keep in mind a few other dates, as you may or may not be eligible for the dividend. South Bow’s dividend yield of 0.00% is lower than the average Oils/Energy company that issues a dividend. These companies have increased their dividends every year for 50+ years. The ex-dividend date is the date after which the traded share will not pay a dividend to its new owner.

Cash Flow Statement

- To achieve diversification, you should select a class of cyclical dividend-paying assets and compare it to its counterpart.

- MSC Adviser is registered as an investment adviser under the Investment Advisers Act of 1940, as amended.

- A shareholder may be indifferent to a company’s dividend policy, especially if the dividend is used to buy more shares.

- For shareholders, the tax treatment of dividends depends on the type of dividend received.

Stock dividends allow companies to share a portion of their profits with its investors. Dividends from stocks can be an additional source of passive income allowing individuals to further grow their finances. Dividend is usually declared by the board of directors before it is paid out. Hence, the company needs to account for dividends by making journal entries properly, especially when the declaration date and the payment date are in the different accounting periods. These dividends pay out on all shares of a company’s common stock, but don’t recur like regular dividends.

How Do Dividends Affect a Stock’s Share Price?

Companies that do pay dividends tend to be larger and more established, with steady growth rather than sudden spikes. S&P 500 companies that have a long history of paying increased dividends are called Dividend Aristocrats. The major factor to pay the dividend may be sufficient earnings; however, the company needs cash to pay the dividend. Although it is possible to borrow cash to pay the dividend to shareholders, boards of directors probably never want to do that.

What is the Definition of Dividends Payable?

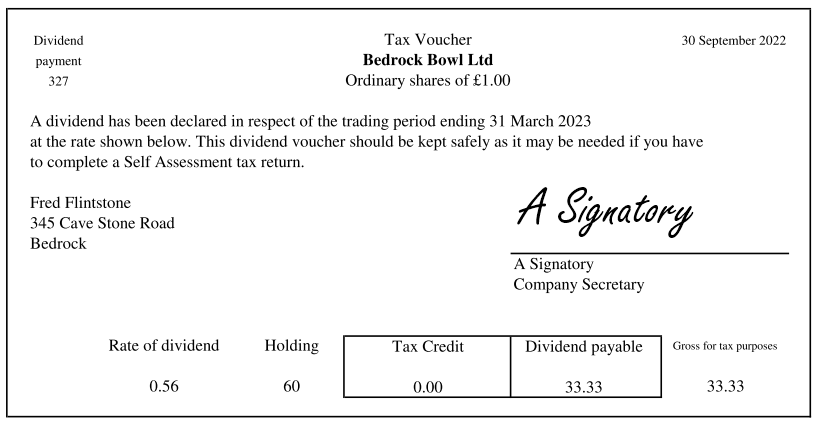

Once declared, disclosure of the dividend will take place under the current liability until paid. The Company is pleased to announce that its Board of Directors has declared a cash dividend in the amount of $0.0048 per common share for the third quarter of 2024. The dividend will be paid to holders of record of First Majestic’s common shares as of the close of business on November 15, 2024, and dor business tax forms will be paid out on or about November 29, 2024. The record date is pivotal in dividend distribution, as it establishes the list of eligible shareholders. To receive the dividend, investors must be on the company’s records as of this date. Individual industries, such as utilities and real estate, often pay higher dividends due to the stability of their revenues and their slower rate of growth.

Why Are Dividends Important?

On the other hand, accounting dividends are considered an expense on either income statement or balance sheet. Dividends payable are dividends that a company’s board of directors has declared to be payable to its shareholders. Until such time as the company actually pays the shareholders, the cash amount of the dividend is recorded within a dividends payable account as a current liability. This can vary from one industry to the next and among companies in different growth phases. Industries that are lower growth but generate stable earnings and cash flows, such as utility companies, often prioritize higher dividend payments to attract investors.

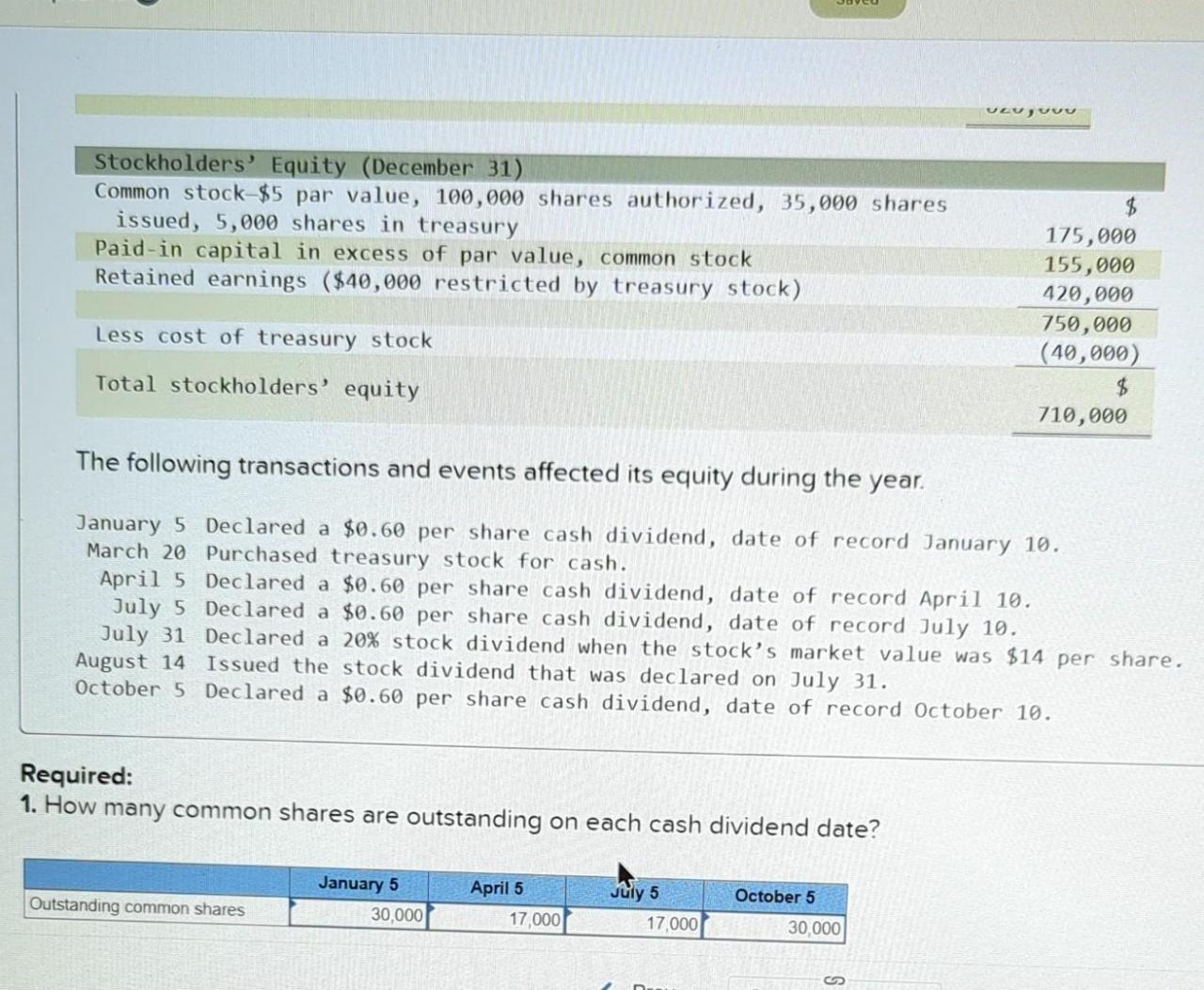

Upon the declaration of dividends by the board of directors, the company must make an entry in its journal to reflect the creation of a dividend payable liability. This entry involves debiting the retained earnings account and crediting the dividends payable account. Retained earnings are the cumulative net income less any dividends paid to shareholders over the life of the company. The debit to retained earnings represents the reduction in the company’s earnings as a result of the dividend declaration. The corresponding credit to dividends payable signifies the company’s obligation to pay the declared dividends to its shareholders.

Depending on a company’s growth goals, earnings and cash flows, its industry, and other factors, the board will determine an appropriate (if any) dividend payment. With a little bit of research, you can start receiving dividend payments from the companies in which you invest. The key is to find good, solid companies that have a history of paying and increasing their dividends. A Dividend is a distribution of a company’s earnings to its shareholders. It also provides income for investors, which can be helpful in retirement planning.

A stock dividend is considered small if the shares issued are less than 25% of the total value of shares outstanding before the dividend. A journal entry for a small stock dividend transfers the market value of the issued shares from retained earnings to paid-in capital. Regular dividend payments should not be misread as a stellar performance by the fund. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account. Dividends payable to shareholders are not considered an expense on a company’s income statement. It is because cash dividends do not affect a company’s net income or profit.